Mineral, Inc. partners with QuickBooks Payroll to supply HR help, presents employee handbook and onboarding instruments in addition to the power to customise job descriptions and set up workplace insurance policies. QuickBooks Payroll’s Premium and Elite plans come with QuickBooks Time, which is a huge plus. Alternatively, RUN’s in-house time-tracking feature is an add-on and prices further, regardless of your plan. Calculates, information and deposits native, state and federal taxes for no extra fee. Our partners can’t pay us to ensure favorable reviews of their services or products. As you grow your worker base, you can upgrade to ADP Workforce Now for a more complete HR and payroll answer.

Benefits Administration

Provides highly effective capabilities on high of payroll, similar to garnishment fee service, state unemployment insurance coverage (SUI) management, background checks, and job posting through ZipRecruiter®1. Get unlimited payroll runs for one clear, upfront month-to-month cost. Handle your budgets and plan expenses with out worrying about frequent or sudden charges.

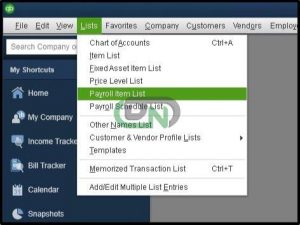

If you’re on the Premium or Elite plans, they even clear within the similar day. Nevertheless, integration with third-party providers can lengthen payroll providers to different nations. These two popular payroll software products diverge from each other on cost, integrations and add-ons. QuickBooks has discontinued using its payroll service with QuickBooks Desktops which have variations older than 2020. Nevertheless, QuickBooks continues to offer its payroll services and lets you use it alongside its different merchandise, including QuickBooks Accounting and QuickBooks Time.

This means you could’t easily monitor your labor costs by particular tasks or analyze profitability on the job degree. These traditional payroll methods deal with all hours the same means, making it almost unimaginable to allocate prices properly when staff work across multiple tasks with different pay or billing charges. Nonetheless, characteristic gaps or handbook steps may incur ongoing prices that outweigh the reduced charges. If the payroll process requires further steps each time payroll is run these added prices shortly add up. Discover the answer that is sustainable and fully automates the repeatable steps. QuickBooks Payroll retains surprise fees to a minimal but costs extra for same-day direct deposit, expedited tax payments, and premium help.

Cost Of Adp Run Vs Quickbooks Payroll

Customers get a mean of $8k per 12 months in added worth with HR services that help them keep their companies rising, hire new staff, practice their teams, and rather more. Any supplier ought to allow you to enter hours or wage info, calculate state, federal, and local payroll taxes, and maintain observe of deductions and withholdings. When comparing providers, make sure completing a pay run is straightforward and intuitive. From paying workers to keeping your HR compliant, here’s a quick overview of what most businesses look for.

Get The Neatest Minds Involved In Handling Your Corporation Accounting

ADP Run and QuickBooks Payroll both provide easy-to-use payroll providers and comprise worker’s compensation and tax submitting administration. Whereas evaluating ADP Run with QuickBooks Payroll, the important thing difference is within the Human Sources features. The greatest difference between ADP and QuickBooks On-line Payroll is that ADP is extra customizable and has more features than QuickBooks On-line Payroll. With greater than 70 years’ expertise in payroll providers for companies of all sizes, ADP cuts checks for about 22 million American employees. QuickBooks Payroll is a pure match for companies already utilizing QuickBooks for accounting. QuickBooks Payroll is tightly built-in with QuickBooks and that simplifies payroll and payroll accounting.

In terms of reliability, since ADP is extra adp quickbooks targeted on offering payroll and HR solutions to businesses of all sizes, many customers rely on this software program for critical payroll functions. On the other hand, QuickBooks Payroll is deemed dependable to some extent, especially for companies already utilizing QuickBooks accounting software program. When evaluating QuickBooks vs ADP payroll, your small business needs come into consideration.

Some of those specifics may assist, so let’s dive into how the most important pros and cons of each ADP and QuickBooks Payroll examine. So, if you can’t discover your favourite app within the market, you may have the ability to negotiate with them to add it to the record. Now that you realize their differences, let’s examine how they compare against one another when it comes to specific features.

- The reason is ADP has the feasibility for unmatched customization, advanced functionality, and enterprise-level assist.

- Nonetheless, after evaluating the overall capabilities of QuickBooks Payroll and ADP, we realized the latter emerges as the main platform.

- In summary, ADP Run is greatest if you’ll like comprehensive employee advantages and wider compatibility with other enterprise apps.

- Whereas the latter is optimized for 50 workers or less, ADP has payroll software plans for businesses with up to 1,000 employees.

ADP offers a number of reasonably priced choices relying on a company’s size in addition to on its payroll and HR requirements, so you only https://www.quickbooks-payroll.org/ pay for what you require. Evaluate packages for your corporation must decide which payroll plan matches best. Over 900,000 small businesses trust ADP® to ship a better payroll expertise. Our small business experience and easy-to-use tools assist you to stay centered on what matters most – your corporation. Amongst the premium suppliers, automated state and federal taxes are par for the course.

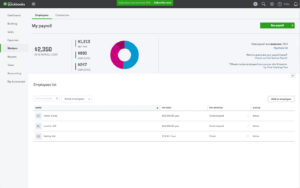

ADP Run is ADP’s on-line payroll service for startups and small companies with as much as 49 workers. We might obtain a commission from our companions when you click on a link to evaluation or purchase a product or service. QuickBooks Payroll offers a straightforward dashboard centered on core payroll capabilities such as calculating paychecks, filing tax returns, and generating reviews. This simplicity reduces the training curve for small business house owners who want to manage their payroll. Discover key features, professionals & cons, and the best different for HR and payroll management. If you’re looking for a payroll tool that allows you to customise your payroll bundle and supply personalized HR and payroll help, ADP RUN is the best way to go.

Christiana Jolaoso-Oloyede writes for media publications, B2B brands and nonprofits. ADP, Inc. and its associates don’t provide funding, tax or legal recommendation to people. ADP, Inc. and its affiliates usually are not affiliated with Gusto, Paychex, QuickBooks Payroll or SurePayroll. QuickBooks Payroll does not provide devoted new client onboarding support for all consumer sizes.